SOCIAL SECURITY RETIREMENT & MEDICARE BENEFITS PLANNING

Because so many people rely on Social Security Benefits in retirement, it is important to have a plan for maximizing your benefits. The decision should not be made in a vacuum, and you need to understand that your plan will not only impact your lifetime benefits, it will also impact the surviving spouse’s survivor benefits.

How You Qualify for Social Security & Medicare Benefits

To qualify for Social Security and Medicare Benefits, American Citizens and Residents Aliens (Green Card Holders) earn “credits” through amounts they earned in salaries/wages or self-employment income. You can earn a maximum of four credits each year. This year, for example, Americans and Residents Aliens earn one credit for each $1,360 of wages or self-employment income. When you have earned and paid Social Security and Medicare Taxes on $5,440, you have earned four credits for the year. Most people need 40 credits, earned over their working lifetime, to receive Social Security Retirement and Medicare Benefits.

Your retirement benefit is based on the average of your highest 35 years of earnings, so higher lifetime earnings result in higher benefits. For comparison purposes, the maximum monthly benefit payable to a high earner who retires in 2019 is $2,861, almost double the average retired worker’s benefit of $1,461.

It is also important to understand what you can expect to receive from Social Security under current law. You can find this information on your Social Security Statement, which can be accessed online when you sign up for a my Social Security account on ssa.gov. If you are not registered for an online account, and are not yet receiving benefits, you should receive a statement in the mail every year starting at age 60.

Income Tax Issues Unique to U.S Citizens & Resident Aliens Who Reside Outside of America (“Expatriates”)

Under IRC Section 911 of the U.S. Tax Code, expatriates are exempt from paying income taxes on certain amount of the income they earned as wages or self-employment outside of the U.S (“Foreign Earned Income Exclusion”). For Tax Year 2018, that exclusion amount is US103,900. For Tax Year 2019, that exclusion amount will be US105,900.

While expatriates are allowed to exclude foreign earned income for Income Tax purposes, that exclusion does not apply to Social Security and Medicare Taxes when it comes to self-employment income.

As such, you should seek competent Tax Advice to optimize the best way to allocate your foreign earned income to maximize your Social Security and Medicare Contributions to benefit you when you retire.

What Age Should I File for My Social Security Benefits?

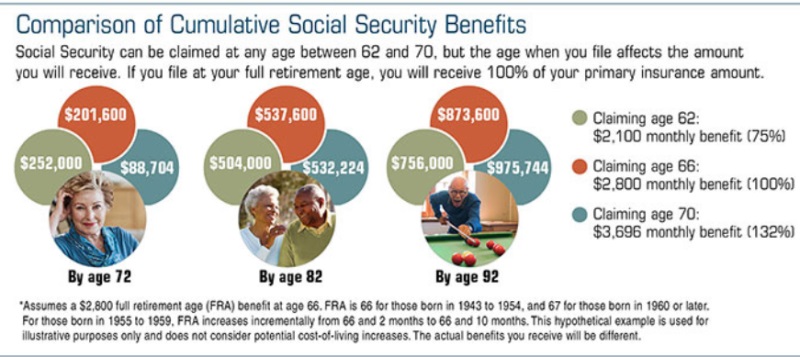

Social Security benefits are available to qualified workers beginning at age 62. However, your benefits at age 62 are approximately 75% of what they would be if you delayed taking benefits to your full retirement age, which is somewhere between age 66 and 67 for Baby Boomers. If you wait to collect benefits until age 70, your benefits will be approximately 132% of what you would have received at full retirement age. However, due to Social Security’s complex rules, 70% of Americans take benefits early, leaving several thousand dollars over their lifespan on the table. For example, a couple with monthly benefit amounts of $1,200 and $600 monthly can expect to receive approximately $125,000 more over their combined lifetimes by optimizing their claiming strategy.

We Can Help You Plan Your Social Security & Medicare Benefits

Even if you are already in your sixties, and do not yet have the required forty credits to qualify for Social Security and Medicare Benefits, we can help you develop a Customized Social Security and Medicare Optimization Plan today.

Give us a call to schedule an appointment to discuss such a plan.